Friday, October 14, 2011

blah blah blah blah

Health care giant Johnson & Johnson likely will discuss its pipeline, recent drug approvals and several important deals when it reports its third-quarter results before the stock market opens Tuesday.

WHAT TO WATCH FOR: Executives will tout progress addressing problems behind an embarrassing string of product recalls that's hurt J&J's revenue and image, and their plans to get some of J&J's many recalled consumer health products back on the market. Last month, J&J said it resumed shipping Tylenol Cold & Flu Severe caplets, just ahead of cold season. SHOCKING!!!!! $$$$$$

Since September 2009, the company has issued more than 25 recalls, including a few prescription medicines, contact lenses and defective hip replacements, for reasons ranging from improper potency to glass or metal shards in liquid medicines. The latest recall, on Sept. 23, affected 200,000 syringes of anemia drug Eprex sold outside the U.S., because of inconsistent potency.

The company may OR NOT! give updates on several pending deals.

Its biggest acquisition ever -- $21.3 billion to buy U.S.-Swiss medical device maker Synthes Inc. and boost its position in the growing market for orthopedic surgery products -- is still expected to close in the first half of 2012.

In late September, J&J paid $175 million to buy out Merck & Co.'s half interest in their 22-year-old joint venture, Johnson & Johnson-Merck Consumer Pharmaceuticals Co., which sells over-the-counter versions of former prescription drugs, including stomach medicines Pepcid, Mylanta and Mylicon. J&J will rename the business McNeil Consumer Pharmaceuticals Co.

A $345 million agreement to sell dermatology businesses that make products including wrinkle and acne cream Retin-A to Canada's Valeant Pharmaceuticals International Inc. is still expected to close by year-end, although the Federal Trade Commission has asked for more information. And J&J's Ethicon Endo-Surgery business agreed in late September to buy privately held SterilMed Inc. It repairs and sterilizes used medical devices such as those made by J&J's biggest division, medical devices and diagnostics.

During the third quarter, the maker of baby shampoo, biologic medicines and birth control pills saw several drugs win new approvals, including extended-release Nucynta, a narcotic pill for moderate-to-severe chronic pain. One product was rejected.

Last month, a panel of advisers to the Food and Drug Administration recommended the agency approve use of anticlotting drug Xarelto for preventing stroke in patients with a common irregular heart rhythm called atrial fibrillation. The FDA is expected to make a decision in the first week of November.

The drug was approved here in July for a much smaller patient group, those getting knee and hip replacement surgery. J&J and partner Bayer Healthcare of Germany plan by year-end to apply in the U.S. and Europe for approval to sell it for patients with acute coronary syndrome, in which blood supply to the heart is blocked, causing chest pain or a heart attack.

Regulators in the European Union in September approved sales of J&J's Zytiga, a new pill for treating advanced prostate cancer after chemotherapy. It was approved in the U.S. in April, so initial sales here likely will be discussed.

Also in September, the EU approved sales of Incivo, one of two new drugs that greatly improve cure rates for tough-to-treat hepatitis C. J&J has rights to sell it in most countries outside North America. Two partners have the rights in North America, where it selling under the name Incivek, and some Asian countries.

J&J's blockbuster immune disorder drug Remicade, already approved for 15 uses, last month won another approval, for treating children with ulcerative colitis. But in July, U.S. regulators rejected a new use for successor drug Simponi, for slowing structural damage in rheumatoid arthritis patients. The company is to meet with FDA officials in November to discuss how to proceed.

Analysts may ask about a tentative settlement reached in August to settle a criminal charge in a multiyear government investigation over marketing psychiatric drug Risperdal for unapproved uses. A company spokeswoman could not say when the settlement will be finalized or disclose the financial penalty. Meanwhile, cases involving improper marketing or overcharging state governments continue in 11 states, but a case was dismissed in West Virginia.

Last week, J&J agreed to pay $85 million to the Department of Justice to resolve allegations it improperly marketed heart failure drug Natrecor for chronic use, instead of just for patients with acute heart failure.

85 Large in fines. Maybe that is the problem with the system. No new drugs from biotech because of marketing? Where is the SCIENCE??????

Monday, October 10, 2011

Q3 Earnings

I have enlisted the help of Tracey and "Big Action" to help in the upcoming onslaught of earnings with my experience with clinical trial data interpretation. Should be a fun Q4.

Monday, October 03, 2011

I think the views of BioTech companies are skewed...LOOK at CELG

The 22nd Annual Cox Classic, presented by The Hibbert Group along with lead sponsor Celgene, will take place on Monday, at the New Jersey National Golf Club, in Bernards.

Since 1989, the event presented by the Steven A. Cox Foundation has raised some $6.4 million to benefit children’s charities and other causes, while attracting a wide range of corporate sponsors and participants from the tri-state area.

This year’s Classic will support the educational outreach efforts of LIFE (LPGA Players in the Fight to Eradicate Breast Cancer), led by Val Skinner in support of the BioCONECT initiative with the Cancer Institute of New Jersey. In addition, the Classic benefits the St. Jude Children’s Research Hospital,

The final beneficiary of the 22nd Annual is Rutgers, The State University of New Jersey, which — through its Department of Chemistry and Chemical Biology — has established the “Steven A. Cox Scholarship for Cancer Research at Rutgers University.”

In addition to the event’s top sponsors, The Hibbert Group, New Jersey National Golf Club and Celgene, the 22nd Annual Cox Charity Classic is backed by many corporate sponsors, including Asurion and Haddad & Partners, AT&T, Atlantic City Electric, Ferriero Engineering, Maritz, Met Life and OSB Co.

Led by 2011 U.S. Solheim Cup Captain, Rosie Jones, the tournament will be headlined by the ladies of the LPGA, who will be providing tips at the practice range prior to the tournament, and participating in several on-course skills contests. The 2011 event features an 18-hole golf tournament followed by a cocktail reception, dinner, and awards ceremony. Highlighting the evening festivities is a post-golf reception that brings participants and dignitaries together to socialize, while celebrating the event’s great charitable endeavors. Participants will have the opportunity to win an assortment of gifts and prizes in a silent auction offering a breadth of sports memorabilia.

“The Steven A. Cox Foundation is extremely proud to host our 22nd consecutive Cox Classic and support three such outstanding beneficiaries,” said Mike Marion, chairman of the Steven A. Cox Foundation. “This event is dedicated to honoring and celebrating the life of Steven Cox, and preserving his legacy through philanthropic initiatives supporting critical women’s and children’s causes.” Cox lost his battle to cancer in 1991 at the age of 32.

While the event is sold out for 2011, companies interested in any of the 11 sponsorship categories available in the tournament, can visit www.coxcharityclassic.com.Wednesday, September 07, 2011

Just Back from HI Timeout

So, Mahalo for you that still check this site out. I'm back on the mainland 9-10 and will get back to work immediately.

P.S.--I wrote this sitting on a beach, with my staff in bikinis, sitting on a beach in Maui. Life is good.

Thursday, September 01, 2011

Labor Day...

Upcoming reports:

3D cancer cell culture models

Abraxane and Nab technology

2011 AACR meeting update from Orlando (late)

market movers and clinical trial updates

clinical trial updates and interpretations. Drugs in development and the potential for investments.

Have a good holiday weekend All.

Wednesday, August 31, 2011

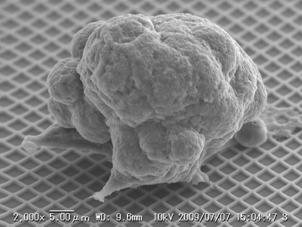

3D Spheriod Cancer Cell Culture

Everyone has/knows matrigel. It's the "3D" culture vessel of choice; which is basically a cocktail of growth factors and basement membrane adherent factors that promote cell growth in non adherent conditions and preventing apoptosis.

We want to study how the tumor grows and how we can get a targeted drug inside that tumor. In vitro, we use siRNA technology to "knock down" the protein e.g., to prevent the protein's function to study it's biology in it's absence. In 3D cell culture this allows us to recreate mini microenvironments to test new drugs.

A 3D cell culture spheroid using matrigel.

Saturday, August 27, 2011

3-D tumor biology: A new stance on in vitro drug design?

this is a spheroid tumor growing in a 3D cultue system.

this is a spheroid tumor growing in a 3D cultue system.

Many questions...can a drug get inside? What is the micro-environment? pH? We can answer these questions. stay tuned!

BioTech hot most watched stocks as of 8-26-2011

The 15 Most-Watched Biotech Stock

People watch stocks for different reasons -- they're waiting for a dip in price, watching for a specific catalyst, gathering all the news and information that might affect stocks they already own, or considering a sell. Regardless of their motivation, we can better understand market sentiment by seeing who's watching what. With the Fool's free My Watchlist service, we have tens of thousands of people telling us the businesses that have, for whatever reason, piqued their interest.

The most-watched biotech stock is ...

Looking at the aggregate data, we see that Gilead Sciences (Nasdaq: GILD ) is above the rest in terms of watch interest, the percentage of people keeping an eye on biotech stocks in general who are specifically watching each company. And for good reason. As CAPS Member CarolinaMatt wrote last week:

Yes I get it. This company is no longer the high-flying early stage pharma star with a everything under patent and profits growing as fast as it can ramp distribution.

But this is no old super-slow moving huge pharma company either. Pricing is at a 2011 P/E of about 9X which suggests maturity and minimal EPS growth. But this company is still projected to grow EPS at 15ish% over the next 3-5 years. Even if they fall short and come in at more like 10-11% EPS gains it is a bargain in the drug space

Here are the rest of the top 15 most-watched companies in the industry with their watch interest along with the stocks' CAPS rating to show the sentiment of our investing community.

| Company | Market Cap (millions) | CAPS Rating (out of 5) | Watch Interest | |

|---|---|---|---|---|

| 1 | Gilead Sciences | $33,828 | **** | 25.5% |

| 2 | Exelixis (Nasdaq: EXEL ) | $1,451 | **** | 9.3% |

| 3 | Amgen | $49,495 | *** | 2.8% |

| 4 | Dendreon (Nasdaq: DNDN ) | $5,444 | ** | 2.6% |

| 5 | ImmunoGen | $611 | *** | 2.4% |

| 6 | Maxygen | $157 | **** | 2.2% |

| 7 | MannKind (Nasdaq: MNKD ) | $491 | ** | 2.0% |

| 8 | PDL BioPharma (Nasdaq: PDLI ) | $827 | **** | 1.8% |

| 9 | Celgene | $26,639 | **** | 1.8% |

| 10 | Geron (Nasdaq: GERN ) | $661 | *** | 1.7% |

| 11 | Vertex Pharmaceuticals | $9,728 | *** | 1.5% |

| 12 | Arena Pharmaceuticals (Nasdaq: ARNA ) | $184 | ** | 1.5% |

| 13 | Human Genome Sciences | $5,165 | ** | 1.4% |

| 14 | Orexigen Therapeutics | $138 | ** | 1.4% |

| 15 | Biogen Idec | $17,626 | *** | 1.1% |

thanks fool.com

there is some interesting phase II data I will cover tomorrow.

Solid tumors and epigentics. I can give some info on that field--is epigenetics drugable?