Monday, March 26, 2007

Very Cool! Vical gets conditional approval for Canine Cancer Vaccine

"This canine melanoma therapeutic DNA vaccine is the first companion animal product to receive conditional approval for our licensee Merial," said Vijay B. Samant, Vical's President and Chief Executive Officer, "which represents a significant advancement for our DNA delivery platform technology, building on the previous approval of a vaccine for farm-raised salmon for another of our licensees. Through our independent and partnered programs, we continue advancing toward initial approvals of DNA-based human health products for infectious diseases, cancer, and angiogenesis. We believe the progress of this DNA-based therapeutic vaccine for canine melanoma bodes well for DNA- based approaches for human melanoma. We are particularly encouraged by the prospects for our Allovectin-7® DNA-based immunotherapeutic for patients with metastatic melanoma."

About Canine Melanoma

Melanoma is an aggressive form of cancer that commonly occurs in the dog's mouth, toes or footpads, and is virtually always malignant at these sites. Normal treatment for canine melanoma includes surgery, radiation, and combination chemotherapy, but even after successful treatment, the melanoma often recurs. Merial's melanoma therapeutic DNA vaccine is designed as an adjunct to treat melanoma in dogs.

What is a DNA vaccine?

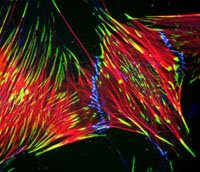

Vical uses DNA vaccines to express various proteins to stimulate the animals immune system or specific proteins to induce cancer cell apoptosis. The same technology exists for humans as well. The vaccine uses a bacterial DNA plasmid [a circular DNA that can replicate outside the nucleus and express proteins] that encodes for proteins of choice that are cloned into the plasmid. I used this technology in my graduate school days when expressing tyrosine kinases in cells.

VICL is up 18 cents per share in late afternoon trading to $4.98 in above average trading volume.

Friday, March 23, 2007

Charles River Forms China Joint Venture

Medical research and services company Charles River Laboratories International Inc. said Friday it has established a drug research and development center in China through a joint venture.

The company said it will be majority owner of the joint venture, formed with Shanghai BioExplorer Co., a Chinese provider of early-stage drug development services.

The venture, which is expected to close at the end of the second quarter, is subject to certain closing conditions, including regulatory approval from the government.

As part of the agreement, Charles River will build a 50,000-square-foot facility in Shanghai. It is expected to open in mid-2008 and provide a wide range of research and development services, including toxicology studies.

"We expect demand for both research models and preclinical services in Asia to significantly increase over the next several years as pharmaceutical and biotechnology companies expand their research efforts in this market, and we intend to play a leading role in this emerging opportunity," James C. Foster, the company's chairman, president and chief executive officer, said in a statement.

Shares of Charles River rose 10 cents to $45.76 in morning trading on the New York Stock Exchange.

Tuesday, March 20, 2007

Gilead Jumps up 2 dollars a share on Outlook

NEW YORK -- Shares of biotechnology company Gilead Sciences Inc. jumped Tuesday following positive sentiment from several analysts citing the company's development pipeline and HIV treatments.

The stock gained $2.63, or 3.7 percent, to reach $73.40 on the Nasdaq Stock Market in afternoon trading. Shares have traded between $52.55 and $74.97 over the last 52 weeks.

The company is attending Lehman Brothers 10th annual global health care conference in Miami this week. Earlier this month, Gilead said its developing HIV treatment GS-9137 met its goal in a mid-stage study.

Merrill Lynch analyst Eric Ende upgraded the company to "Buy" from "Neutral" and set a price target of $91 Tuesday, citing the company's products and upcoming launches.

"We view Gilead's HIV franchise as solid with a relatively low risk of disappointments because the drugs are standard of care and unlikely to experience any serious competitive threats for the foreseeable future," he wrote in a note to investors.

Ende also expects the company to launch Ambrisentan, aimed at treating pulmonary arterial hypertension, in the middle of 2007. That drug could see sales of $1 billion, he said. Also, the company could launch Aztreonam for cystic fibrosis in the middle of 2008 and it could see peak sales between $400 million and $500 million.

RBC Capital Markets analyst Jason Kantor reaffirmed his "Outperform" rating and price target of $78, citing the company's outlook.

"Gilead has steadily gained share in U.S. HIV market with the launch of Atripla and the sustained market presence of Truvada," he wrote in a note to investors. "Not only do we expect continued steady growth in market share, but we are not aware of any potential competitive threats to Gilead in development." [That's huge!]

Kantor also increased his 2007 earnings per share estimates, citing higher-than-expected revenue from the company's HIV drugs. He is also including some anticipated sales of Ambrisentan, as he too expects a launch in the middle of 2007.

Atripla is a fixed-dose combination of three widely used antiretroviral drugs, to be taken in a single tablet once a day, alone or in combination with other antiretroviral products for the treatment of HIV-1 infection in adults. Atripla is the first fixed dose combination available in the United States to combine two different classes of antiviral drugs in a single pill. This “one-pill-once-a-day” product to treat HIV/AIDS combines the active ingredients of Sustiva (efavirenz) a Nonnucleoside Reverse Transcriptase Inhibitor (NRTI), with Emtriva (emtricitabine) and Viread (tenofovir disoproxil fumarate), two Nucleoside Reverse Transcriptase Inhibitors (NRTIs). Emtriva and Viread are also available in a fixed dose combination known as Truvada.

Monday, March 19, 2007

Acadia Schizophrenia Drug Meets Endpoint

SAN DIEGO-- Acadia Pharmaceuticals Inc. said Monday its schizophrenia drug met its goal in a Phase II trial, and shares nearly doubled in value.

The company's ACP-103 trial drug to treat schizophrenia showed a statistically significant level of effectiveness in the trial, which tested the drug used in conjunction with both a generic typical antispsychotic drug, haloperidol, and risperidone, an atypical antipsychotic drug.

Schizophrenia is a chronic, debilitating mental illness characterized by disturbances in thinking, emotional reaction and behavior.

"The use of ACP-103 in co-therapy with risperidone or other modern atypical antipsychotics may result in enhanced efficacy and an improved side effect profile," the company said in a statement.

Nearly all antipsychotics are 5-HT2A receptor inverse agonists, in that they can attenuate the basal constitutive signaling activity of this receptor, in contrast to neutral antagonists that can only block agonist-induced responses. 5HT receptors bind serotonin in the brain.

Acadia shares soared $5.86, or 87.6 percent, to $12.60 in morning trading on the Nasdaq Stock Market.

Saturday, March 17, 2007

Hollis-Eden stock roars up 29%

The share spike, which made the stock the biggest percentage gainer on the Nasdaq Friday, reversed some of its prior-week losses that followed the contract rejection of Neumune by the U.S. Department of Health and Human Services.

Neumune was being developed to treat acute radiation syndrome under the U.S. government's Project BioShield program.

Analyst Joseph Pantginis of Canaccord Adams said as a public company, Hollis-Eden needed to go after drugs with real markets where it could potentially get return on investment.

The San Diego-based company had spent between $80 million to $90 million over four years developing Neumune with no current potential for reimbursements from the government.

It plans to file an investigational new drug application to treat type 2 diabetes by the end of the month. The company is also considering the same compound as a treatment of rheumatoid arthritis.What is Neumune and how does it work?

Neumune was being developed as an acute radiation syndrome drug. Neumune or 5-androstenediol (AED), is a naturally occurring adrenal steroid hormone which stimulates multilineage recovery of bone marrow cells [Immune system cells like macrophages and T cells]. In other words, it stimulates the immune system to recover from radiation and grow new cells derived from the bone marrow. This relates directly to survival, in that any opportunistic infections can be stopped by the body's ability to defend itself unlike an irradiated animal which cannot defend itself without a functioning immune system.

AED is often misused by athletes as a performance enhancing anabolic steroid as well.

HEPH.O closed friday's trading up 74 cents per share to $3.25.

Friday, March 16, 2007

Biotech News Friday: Trimeris stock plunges on CEO's departure

The company said late Thursday afternoon that co-founder and CEO Dani Bolognesi, who also acts as chief scientific officer, would resign today. He will stay on as a "scientific consultant" to Trimeris through October 2008. Robert Bonczek, CFO and general counsel, plans to step down on April 30.

Trimeris officials did not cite a reason for the departure of either Bolognesi or Bonczek.

The company has named E. Lawrence Hill Jr. acting president and chief operating officer. Hill currently is president of Hickey & Hill Inc., a management services firm, and formerly served as CEO of Deltagen Inc. from 2003 through 2005.

Shares of Trimeris were down almost 22 percent to $7.86 in early trading Friday.

Thursday's announcement came on the heels of a difficult year for Trimeris, whose HIV drug Fuzeon has failed to reach expectations. The company announced in December plans to slash 25 percent of its work force.

Also Thursday, the company released 2006 fourth quarter and full-year financial results above Wall Street expectations.

Thursday, March 15, 2007

FDA Approves GlaxoSmithKline's TYKERB(R) in combination for treating advanced/metastatic breast cancer

-- GlaxoSmithKline plc announced today that the United States Food and Drug Administration (FDA) approved TYKERB(R) (lapatinib), in combination with Xeloda(R) (capecitabine), for the treatment of patients with advanced or metastatic breast cancer whose tumors overexpress HER2 and who have received prior therapy including an anthracycline, a taxane, and trastuzumab. It is the first targeted, once-daily oral treatment option for this patient population. TYKERB was granted Priority Review by the FDA in November 2006.

"Tykerb is a significant breakthrough for women with advanced HER2 (ErbB2) positive breast cancer. The data clearly show that this small molecule, oral, targeted agent, in combination with capecitabine, is effective for women whose disease has progressed on previous therapies, including anthracyclines, taxanes and trastuzumab," said Paolo Paoletti, MD, Senior Vice President of the Oncology Medicine Development Center at GSK. "The approval of TYKERB demonstrates our R&D organization's strong commitment to the discovery and development of novel cancer treatments. We are dedicated to the further study and development of Tykerb in a variety of settings including adjuvant breast cancer as well as in other solid tumor types."

This approval reflects more than 16 years of research, including more than 60 clinical trials and investigator-initiated collaborative research studies. TYKERB inhibits two validated targets in oncology, the kinase components of the EGFR (ErbB1) and HER2 (ErbB2) receptors, commonly associated with cancer cell proliferation and tumor growth. As a targeted therapy, TYKERB is designed to interfere with discrete cellular processes or disease mechanisms prevalent in cancer. TYKERB will be available in the United States within two weeks and, as an oral therapy, offers added convenience for patients.

GSK finished today's trading down 42 cents at 54.83 per share. Monoclonal antibody treatments are gaining in popularity due to their target specificity. It remains to be seen if TYKERB has the same cardiac side effects as herecptin.See post from January 9th for more info on herceptin and breast cancer.

Wednesday, March 14, 2007

Affymetrix Rises on Illumina Verdict

NEW YORK-- Shares of Affymetrix Inc. climbed Wednesday after the company, which makes products used in analyzing genetic information, won a series of patent infringement claims against Illumina Inc.

Affymetrix said Tuesday a Delaware jury awarded it $16.7 million, finding that Illumina's scanners, software, arrays and other products infringed on five Affymetrix patents.

Robert W. Baird & Co. analyst Quintin Lai upgraded the stock to "Outperform" from "Neutral." He said the jury awarded Affymetrix a royalty rate of 15 percent on $111 million in revenue from 2002 to 2005 -- a higher rate than Affymetrix had sought. Illumina says it will appeal the ruling.

"If we assume 15 percent as the forward royalty rate, then Affymetrix stands to benefit from Illumina's current high-growth potential," said Lai. He raised his price target for the stock to $35 per share from $26, and reduced his target for shares of San Diego-based Illumina to $34 from $52.

Shares of Santa Clara, Calif.-based Affymetrix rose $1.99, or 7.5 percent, to $28.61. Illumina stock was up 80 cents, or 2.7 percent, to $29.63. Both stocks trade on the Nasdaq Stock Market.

REMEMBER that gene chips are a powerful tool that researchers use to identify genes are are activated or inhibited in disease states. Basically, DNA sequences are stuck to a slide and disease DNA is passed over it, where alike base pairs bind to each other or not. It's then put in a machine to look for differences. I posted about how this method works; on 9-8-06 you can search for that date and find more indepth info.

AFFX is up in afternoon trading 6.3% (or $1.71 per share ) to 28.36/share. The stock was upgraded as well.

Friday, March 09, 2007

Update: La Jolla Pharma still cruising

Rock on!

Thursday, March 08, 2007

In my backyard: La Jolla Pharma Shares Surge on data

LJPC continues to surge thursday, trading up over 34% (over $1.07 per share) at $4.23.

Whats

Riquent is a new treatment for Lupus. Lupus, which affects about one million people in the U.S. and Europe, is a chronic, potentially life-threatening autoimmune disorder in which patients' diseased B cells produce antibodies to double-stranded DNA (dsDNA). These antibodies are believed to cause lupus kidney disease that can lead to kidney failure, dialysis, kidney transplantation, and death.

It's mechanism of action is not fully understood, LJPC is using a technology that helps induce self tolerance from diseased B cells. What most likely is happening is Riquent is a peptide [small protein] that binds to the antibody producing cells that mimics another self protein. The antibody producing cell sees this protein as self and says "hey man, Im mounting an immune response to myself and that's not good. I should slow down". Thus less antibodies to self DNA and slows the progression of the disease.

Wednesday, March 07, 2007

Tercica Shares Surge on Settlement

NEW YORK-- Shares of drug maker Tercica Inc. surged Wednesday, a day after a rival agreed to stop marketing a competing drug.

Tercica and partner Genentech Inc. had sued a Glen Allen, Va.-based drug maker called Insmed Inc. Insmed makes Iplex, which treats growth disorders. Under a settlement announced late Wednesday, Insmed agreed to stop selling Iplex as a drug treating growth disorders.

Analysts called the settlement a big win for Tercica. BMO Capital Markets analyst Thomas Shrader said Tercica no longer has to share the spotlight with Insmed. Plus, the Brisbane, Calif.-based company can now focus its attention on doctors instead of lawyers.

Shares of Tercica rose 87 cents, or 16.3 percent, to $5.77 on the Nasdaq Stock Market. In late afternoon trading today, TRCA is continuing to climb---up 22% to $5.95 per share.

What's the drug?

A complex term helps explain why some children are much smaller than others their age. Insulin-like growth factor deficiency, or IGFD, is a term that describes lower than expected levels in the body of Insulin-like Growth Factor 1 (IGF-1), a naturally occurring hormone that plays a central role in growth. The drug is a human recombinant [man-made] insulin growth factor that is injected into children with severe primary IGF-1 deficiency. When injected, the insulin receptor binds it and leads to intracellular signaling to growth.

Tuesday, March 06, 2007

CV Therapeutics Drug Fails Study

The drug is already approved as a second-line treatment for chronic angina.

The company said a Phase III clinical trial studying the drug for other uses as a treatment of coronary syndromes did not meet its primary study goal for effectiveness. But the safety results gathered from the study could support expansion of the drug into a first-line treatment.

Full results will be released March 27 at the American College of Cardiology Scientific Session in New Orleans, the company said.

Shares of CV Therapeutics rose 10 cents to close at $12.30 on the Nasdaq Stock Market.

CVTX in after hours trading, plunged down over 27% or $3.34 to a price of 8.96 a share.

Electrical excitation in cardiac cells causes sodium ions to enter the cell through membrane sodium channels.

Ranolazine used for angina works by reducing sodium entry into cardiac cells through those sodium channels. As a result, it improves sodium and calcium homeostasis and contractile function and balancing out ions that are the end result of ischemia.

BioCryst stock jumps on news of bird flu

BioCryst signed a licensing agreement with the Japanese biotech Shionogi for the development of peramivir, one of the most advanced experimental treatments for bird flu.

The licensing deal gives BioCryst Pharmaceuticals a $14 million up-front payment, with potentially more than $100 million in other payments and up to 20 percent royalties on Shionogi & Co's. anti-viral drug sales in Japan.

BioCryst's stock price jumped more than 6 percent on the news.

If peramivir gets approved by the Food and Drug Administration, it could some day rival the bird flu anti-viral Tamiflu produced by the Swiss drug giant Roche and the biotech Gilead Biosciences (down $0.21 to $69.78, Charts). GlaxoSmithKline (up $0.61 to $54.58, Charts) also produces a bird flu anti-viral: Relenza.

BioCryst, based in Birmingham, Ala., is one of the most active companies in developing potential treatments for the notorious H5N1 strain of bird flu, which has decimated bird flocks in Asia and Europe and led to at least 160 human deaths. Some bird flu experts fear that the H5N1 virus could mutate into a form that is contagious among humans, possibly leading to an outbreak like the 1918 pandemic that killed as many as 50 million people.

Feds award bird flu contracts to Novartis, Glaxo

Health and Human Services awarded BioCryst on Jan. 4 with a $102.6 million grant for the development of peramivir for the treatment of bird flu and seasonal flu. But many experts believe that a vaccine -- not an anti-viral - is the best way to deal with the threat of a pandemic.

An FDA advisory panel on Feb. 27 recommended the approval of an experimental vaccine from the French drugmaker Sanofi-Aventis (up $0.61 to $42.25, Charts). If the agency takes the advice of its experts and approves the product, it would be the first FDA-approved bird flu vaccine. The government has already begun to stockpile it.

What is Peramivir?

Peramivir is an anti-viral drug in the category of neuraminidase inhibitors. Anti viral drugs Tamiflu and Relenza are also neuraminidase inhibitors. These drugs shut down neuraminidase so the virus is not allowed to be released from host cells, therefore stopping the virus from infecting healthy cells.

Peramivir seems to be effective on influenza viruses that have become resistant to Tamiflu. Studies have been done on mice and ferrets so far.

Preclinical studies show effectiveness of peramivir in a broad range of influenza viruses including the H5N1 avian influenza virus.

BioCryst stock is trading (ticker symbol BCRX nasdaq) up 5.7% or 51 cents a share. Late afternoon trading price was $9.55/share.

Monday, March 05, 2007

Aftermarket News: InterMune Discontinues Phase 3 INSPIRE Trial of Actimmune in Idiopathic Pulmonary Fibrosis

INSPIRE was a randomized, double-blind, placebo-controlled Phase 3 study designed to evaluate the safety and efficacy of Actimmune(R) in IPF patients with mild to moderate impairment in lung function. The primary endpoint was survival time. The lack of benefit stopping boundary was developed to allow for early study termination in the event interim data were statistically inconsistent with a clinically meaningful treatment effect of Actimmune(R). InterMune plans to submit the data from the Phase 3 INSPIRE trial for presentation at an appropriate medical meeting and for publication in a peer-reviewed journal.

"The interim results of the INSPIRE trial and our decision to discontinue the trial are disappointing," said Steve Porter, M.D., Ph.D., Chief Medical Officer at InterMune. "We are extremely grateful for the strong support we received from physicians, healthcare providers and especially the patients who participated in the clinical evaluation of Actimmune(R). The overall conduct of the study by investigators and the participation by patients were exemplary."

Nasdaq: ITMN in after hours trading is down 18.7% down 5.25 dollars per share at $22.80. OUCH!

Actimmune is a human cytokine termed Interferon gamma-1b being used to treat idiopathic pulmonary fibrosis (that is an inflammatory lung disorder of unknown origin characterized by abnormal formation of fibrous tissue between the tiny air sacs of the lungs. ) IFN-1b acts as a potent stimulator of the immune system.

Memory Pharma Drops on Failed Study

NEW YORK-- Shares of Memory Pharmaceuticals Corp. fell Monday after the biotech drug maker said results of a clinical study for one of its drugs to treat bipolar mania failed to show significant effectiveness.

Memory Pharmaceuticals shares fell 97 cents, or 31 percent, to $2.16 in afternoon trading on the Nasdaq at more than double their average volume. Shares have fallen from a 52-week high of $4.94 set in February.

Results of the midstage study showed a significant number of bipolar patients given the experimental drug MEM 1003 did not reach at least a 50 percent improvement on a mania scale, or other measured targets, compared to patients given a placebo. Bipolar disorder is major mood disorder where sufferers swing between episodes of mania and depression.

As a result, Lazard Capital analyst Terence C. Flynn cut the rating on the company to "Hold" from "Buy."

Flynn had expected the drug to be effective against acute mania, but given the results, does not think the company will advance study for this condition.

Despite the company's reassurance that the drug is still being studied as a treatment for Alzheimer's disease, Flynn said that he is no longer optimistic, and removed MEM 1003 from his model.

The analyst estimated a cash per share technology value of 50 cents for MEM 1003, with $2 for the company's MEM 3454 Alzheimer's drug candidate.

MEMY is trading down over 32% (thats over 1 dollar per share) in today's late afternoon session at $2.12/share.

MEM 1003 is a neuronal L-type calcium channel modulator. L-type channels are not only essential for cardiovascular function [they are targets for high blood pressure drugs as well] but are also widely expressed in neurons, (neuro-)endocrine and sensory cells. We know that these channels contribute to memory and control of mood and drug-related behavior, as well as vision, hearing, the release of a variety of hormones and skeletal muscle contraction. By blocking L-type calcium channels, MEM 1003 may regulate the flow of calcium. Calcium inhibition may enhance cognition by re-establishing normal levels of calcium, which is essential for normal functioning of neuronal pathways.

Friday, March 02, 2007

OncoGenex Delays IPO AGAIN

OncoGenex Delays IPO

NEW YORK — Biotechnology company OncoGenex Technologies Inc. has pushed its initial public offering (IPO) into next week. AGAIN.

The Vancouver, British Columbia-based company originally planned to begin trading on the Nasdaq Stock Market Wednesday, but postponed the offering after a volatile day of trading on global markets Tuesday.

The initial public offering is now expected to trade Tuesday, according to underwriters RBC Capital Markets.

"Once again, clearly we have a situation where an already tough biotech market has been made tougher by the tone of the market and dedicated biotech buyers are taking a wait and see attitude," said Scott Sweet, managing director of IPOboutique.com, an IPO research service near Tampa, Fla.

The delay comes after the company lowered its estimated IPO price range to $7.50 to $8.50 a share, from $10 to $12 in an amended filing with the Securities and Exchange Commission Thursday.

The underwriters also increased the size of the offering to 5 million shares from 4.5 million shares.

OncoGenex is attempting to commercialize new cancer therapies that address treatment resistance in patients.

The stock will trade under the ticker symbol "OGXI." By the time the initial IPO for the stock sells, and after what the market did today [down nearly 1%] this IPO might be at 5 dollars!!!

Thursday, March 01, 2007

Biotechnology Mid-Day trading Report

The DJ Wilshire Pharmaceutical Index was down nominally at 2,336.25 and the DJ Wilshire Biotechnology Index fell 1.6% to 3,052.20.

Amgen was the notable decliner among the large caps, with shares dropping 3% to $62.35.

The biotech giant said late Wednesday that the Securities and Exchange Commission had launched an informal investigation into a halted study run by the company for its anemia drug Aranesp as a possible treatment for head and neck cancers.

Amgen also said it will participate in a Food and Drug Administration meeting that will discuss using such drugs as Aranesp to treat certain types of cancer patients. The meeting is scheduled for May 10.

Bristol-Myers Squibb was one bright spot, with shares trading up 1% at $26.68. Analysts at UBS upgraded the stock from neutral to buy, citing valuation and its attractiveness as a takeover target.

Wyeth shares also rose, up 1% at $49.30. The drugmaker said late Wednesday that it sees first-quarter 2007 earnings beating the current Thomson Financial polled analysts' average estimate of 85 cents a share.

Wyeth also said that the number of cases filed against it over its hormone treatment Prempro has not substantially increased since its last update. About 8,400 women have filed suit, claiming they were injured by the product.

Shares of Hana Biosciences jumped 5% to $4.00. The stock's rating was upped to buy by Cantor Fitzgerald. End of Story

After this mornings meltdown, some good news: Alpharma's Pain Reliever Gets FDA Nod

Alpharma expects to launch the capsule in the second quarter, the specialty pharmaceutical company said in a statement.

ALO is up 47 cents per share in late afternoon trading at $26.81/share in light trading (volume just under 482K0).

What is Kadian and how does it work?:

Kadian is sustained release morphine designed for 12-24 hour dosing. Cancer patients with chronic pain were randomized in clinical trials. Remember that morphine is an opiate which elicits its mechanism of action via specific receptors in the brain and GI tract. The major classes of opioid receptors are mu [for morphine], delta and kappa. These receptors are G protein coupled and each subtype can elicit varying effects. They effect intracellular signaling pathways such as calcium release, protein phosphorylation and ion gating.