ROCKVILLE, Md. — Shares of EntreMed Inc. jumped Thursday after the drug developer said its experimental cancer drug showed activity against tumors in preclinical studies.

EntreMed shares rose 8 cents, or 3.9 percent, to $2.15 in morning trading on the Nasdaq. Shares have traded between $1.43 and $2.99 over the past 52 weeks.

The company said preclinical results for its cell cycle inhibitor MKC-1 showed that the compound interfered with tumor cells in models of lung cancer and pancreatic cancer when used by itself and with the cancer drug Tarceva.

Data showed that MKC-1 binded to tumor cells and destabilized structural components within the cells.

What is MKC-1 and how does it work?

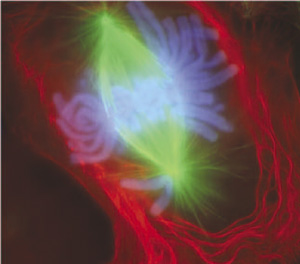

Specifically, MKC-1 has been shown to inhibit mitotic spindle formation, prevent chromosome segregation in the M-phase (mitosis) of the cell cycle, and induce apoptosis or cell suicide, in multiple cell lines. These effects are consistent with a mechanism resulting from MKC-1 binding to its intracellular targets, tubulin and the importin beta proteins. The importin beta family of proteins plays a critical role in nuclear transport and cell division.

Tubulin is a constituent of microtubules. Microtubules are like cables inside the cell that help pull apart the chromosomes after they replicate such that each daughter cell receives an exact copy.

In the picture above the microtubules are green, attached to the chromosomes, blue, to pull the duplicated copies apart into each new cell.

The biotechnology company ENMD is slightly down in afternoon trading 5 cents to $2.02 with triple the normal volume.